Activity Based Costing

Summary

Activity Based Costing ("ABC") is an approach to solve the problems of traditional cost management systems which are often unable to determine accurately the actual costs

of production and of the costs of related services. Instead of using broad arbitrary percentages to allocate costs, ABC seeks to identify cause and effect relationships

to objectively assign costs. Once costs of the activities have been identified, the cost of each activity is attributed to each product to the extent that the product uses the activity.

In this way ABC often identifies areas of high overhead costs per unit and so directs attention to finding ways to reduce the

costs or to charge more for costly products.

Activity Accounting with Kohler and Staubus

In the 1930s, the Comptroller of the Tennessee Valley Authority, Eric Kohler developped the concept of Activity Accounting.

The Tennessee Valley Authority was engaged in flood control,

navigation, hydro-electric power generation, etc. Kohler could not use a traditional managerial accounting system for these

kind of operations. Instead Kohler defined activities and introduced activity accountants. An activity is (a portion of) a work carried out by a (part of)

a company. For each activity Kohler created an activity account (Aiyathurai,

Cooper and Sinha, 1991, PP 61-64). An activity account is an income or expense account containing transactions over which

an activity supervisor exercises responsibility and control (Kohler, 1952, pp, 18-19). Thus instead of determining

the costs of a product, Kohler determined the costs of an activity.

In 1971 Staubus described another activity accounting system. Staubus also created an account for every activity. On the

left side of this account Staubus recorded the costs of the inputs of the activity. These inputs are the outputs from

previous activities within the company and / or outputs from another entity (for instance an outside supplier). On the right

hand side of the account Staubus recorded the value of the output of the activity. The outputs to another activity are

measured at standard costs. If however the output is sold to a customer, the output is measured at the

net realizable value (selling price minus selling costs). Staubus activity accounting culminates in a comparison of

outputs, at standard cost or net realizable value, and inputs (Staubus, 1971).

Activity Cost Analysis at General Electric

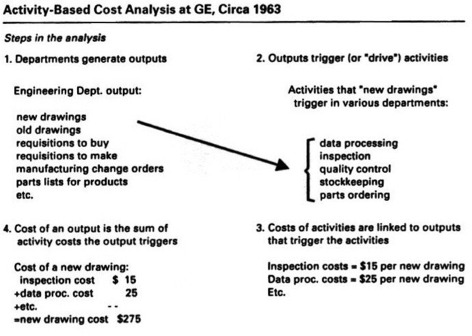

With an Activity Cost Analysis General Electric performed during the sixties, General Electric wanted to get better control of indirect costs by controlling the activities that cause the indirect costs (Johnson, 1992, pp 131-141).

In 1963 General Electric formed a team which had to study indirect costs. This team focused mainly on indirect activities

in GE such as data processing, inspection, quality control etc. and determined the costs of these activities. Then they

identified the causes of these activities ("key controlling parameters"). For instance a new drawing,

made by the engineering department is a key controlling parameter and triggers activities such as data processing,

inspection, quality control, etc. The team also collected information about the quantity or count of each key controlling

parameter, such as the number of new drawings per period. Then the team estimated the total costs per unit key performance

parameter, for instance the costs per 1 new drawing made by the engineering department:

Activity Based Costing in the 1980s and 1990s

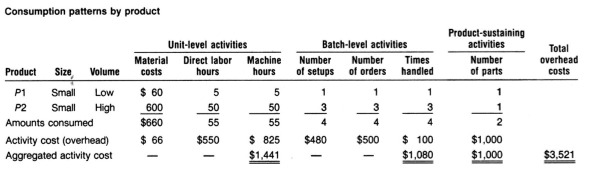

The activity based costing systems, described by Robin Cooper and Robert Kaplan in the 1980's and 1990's, has attracted much attention. These systems identifies the major activities of a facility's production process and then classifies these activities into one of the following categories:

- unit-level activities;

- batch-level activities;

- product-sustaining level activities and;

- facility-sustaining level activities.

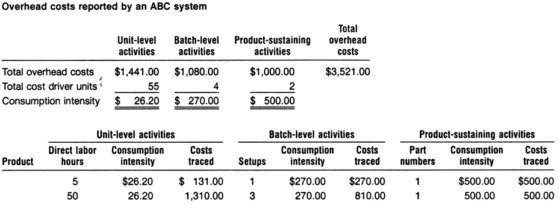

The costs of the unit-level, batch-level and product-sustaining level activities are attributed to products based on each product's consumption of those activities. The costs of facility-sustaining activities are allocated to products arbitrarly or treated as period costs. In the example below, described by Robin Cooper (1994, pp. B1-20-B1-21);

- the number of direct labor hours a product consumes is the cost driver for unit-level activities;

- the number of setups a product consumes is the cost driver of batch-level activities;

- and the number of parts a product consumes is the cost driver of product-sustaining level activities.

According to Robin Cooper activity based costing systems can be used to monitor how an organization's resources are consumed and helps to manage consumption and spending in a company. With activity based costing systems managers can attempt to perform its activities more efficiently, reprice poducts or alter the company's product mix (Cooper, 1994, pp. B1-9).

BIBLIOGRAPHY

- Aiyathurai, G., W. W. Cooper and K. K. Sinha, 'Note on Activity Accounting', Accounting Horizons, Dec 1991, pp. 60-68.

- Cooper, R., 'Activity-Based Costing for Improved Product Costing', Handbook of Cost Management 1994 Edition, Ed. B. J. Blinker, Warren Gorham Lamont, 1994, pp. B1.1 - B1.51.

- Johnson, H. T., 'Relevance Regained: From Top-Down Control to Bottom-Up Empowerment', The Free Press, 1992.

- Kohler, E. L., 'A Dictionary for Accountants', Prentice Hall, 1952.

- Staubus, G. J., 'Activity Costing and Input-Output Accounting', Richard D. Irwin, Homewood, 1971.